Have to have approval: Ahead of using a person of such apps, you must get acceptance and join your banking account. Depending on the application, you may additionally ought to go through your employer. Some apps do the job with employers for payroll advancements and you will’t use the program if your organization isn’t enrolled.

The application is absolutely free to employ and advances haven't any desire or fees, but Earnin does request an optional “suggestion” any time you ask for an progress. The amount that you choose it tip is totally your choice.

When your account is suitable, you could temporarily get $two hundred from Income Application by choosing the “Borrow” alternative. If accredited, you’ll see these money as part of your application’s financial loan equilibrium. You’ll pay desire and repay the quantity in a lump sum or in partial payments by your due day.

EarnIn is really a properly-known money advance application in the United States which offers interest-free of charge income advancements as many as $750, among the the very best within the US hard cash progress app market.

Jordan Tarver has invested seven years masking home finance loan, particular personal loan and company bank loan articles for major fiscal publications including Forbes Advisor. He blends understanding from his bachelor's degree in business enterprise finance, his practical experience to be a best performer during the mortgage field and his entrepreneurial accomplishment to simplify advanced money matters. Jordan aims to generate home loans and financial loans comprehensible.

Personal savings and money sector accounts (35% of complete rating): The best scores check out banks, financial loans and fintech organizations with significant curiosity fees and reduced or no expenses or least opening deposits.

1 Paycheck Progress is provided by Finco Advance LLC, a economic technology corporation, not a bank which is for qualified prospects only. Your precise obtainable Paycheck Advance sum is going to be displayed to you within the cellular app and could improve every so often.

A considerable danger with using a money-borrowing application is the results of missing payments. Depending on the conditions, apps may possibly increase late service fees, boost your curiosity fee, or the two. Late or missed payments also can impression your credit history score, making it demanding to borrow all over again Sooner or later.

But for more substantial amounts, you might require to take into consideration getting a personal bank loan from a credit score union. DCU’s Fast Loan is an excellent decision since it will offer as much as $two,000 in cash for an emergency.

LendingClub can be a solid lender permanently credit rating borrowers and some truthful credit score borrowers that implement right on its website. It's easy to prequalify with LendingClub, particularly when you might be awkward providing your Social Security quantity, as the company does not have to have it at the prequalification stage. (You have got to present it if you progress forward having a whole application.)

In case you have feed-back or questions on this post, remember to e-mail the MarketWatch Guides workforce at editors@marketwatchguides.com.

Upstart may well charge an origination price as superior as 12%, but fantastic-credit score borrowers may not be charged a single in the least.

Overdraft service fees may possibly cause your account being overdrawn by an sum that is bigger than your overdraft coverage. A $15 rate may possibly utilize to each qualified transaction that delivers your account unfavorable. Harmony must be brought to no less than $0 inside 24 hrs of authorization of the main transaction that overdraws your click here account to avoid the payment. Learn more at .

The data in our testimonials could possibly be various from what you discover when visiting a financial institution, company provider or a selected merchandise's Web page. All products and services are offered without having guarantee.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Barret Oliver Then & Now!

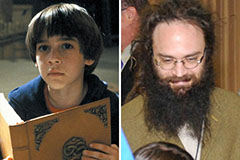

Barret Oliver Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!